Milestone Expenses

Why you should build a savings fund, how to buy a car or home, and strategies for retirement planning.

This is a chapter preview. To read the full chapter, click here.

TL;DR

- Save three months' worth of living expenses in cash for unexpected expenses and to hedge against potential unemployment

- To prepare for a major purchase, understand your budget and reasons for the expense, familiarize yourself with the market and purchase process, and plan for ongoing expenses

- Begin saving for retirement early in your career by investing in an IRA, 401k, or comparable tax-advantaged account, but don’t overinvest because of the repercussions of withdrawing money early

We save money because not all purchases fit within a monthly budget. Unexpected life events, milestone expenses, and retirement all require more money than can be earned in a month. Saving a portion of your income every paycheck is the first step in preparing for these larger expenses.

Emergency savings fund

As you begin saving money, the first milestone you should save for is an emergency savings or “rainy day” fund. An emergency savings fund refers to money held in an accessible place, like a savings account, to use for an unexpected life event. As a rule of thumb, an emergency savings fund is typically enough to cover at least three months of living expenses if you suddenly find yourself unemployed. The money put aside should grow over time as your income and responsibilities increase.

You can use an emergency savings fund for expenses not covered by an insurance policy or warranty. Examples include medical bills and car or home repairs. Having an emergency savings fund prepares you for the unexpected.

After you build your emergency savings fund, consider investing additional savings for long-term financial goals — money that you won’t need for at least a year — such as milestone expenses and retirement. Money in a savings account does not always outpace the inflation rate. Over the past 20 years, inflation has increased an average of 2.0% each year, while savings accounts offer average returns of 0.06% interest. This means that by the end of one year, you could expect an item that costs $1.00 to cost an inflation-adjusted $1.02, while $1.00 held in a savings account would be worth approximately $1.0006.

View this post on Instagram

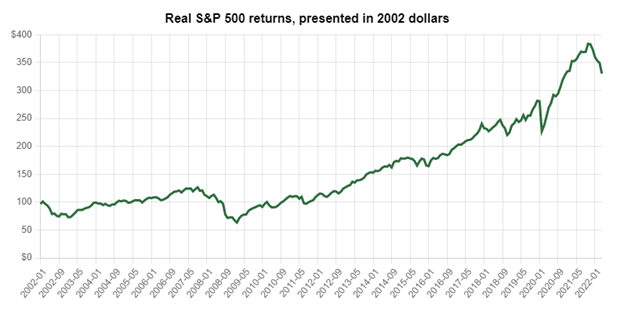

For reference, during the same 20-year period, the S&P 500, a stock index tracking 500 top-performing companies, increased in value by 8.64% on average each year, providing investors with an inflation-adjusted annual return of approximately 6.13%. One dollar invested in the S&P 500 at the beginning of the year would have been worth roughly $1.0864 – $1.0613 adjusted for inflation – on paper by the end of the year.

The real return displayed shows the S&P 500 performance from 2002 to 2022 adjusted for inflation. You can read strategies for investing in Grow.

Therefore, investing savings beyond your emergency fund can help you build wealth over time. You can spend accumulated wealth on milestone expenses such as a car purchase, a home purchase, and retirement. Because of their size, each expense comes with advantages, risks, and a unique saving or purchase process. Read on for an overview of how to prepare for each.

Financing a car

Car ownership advantages

American infrastructure was built with driving in mind. 87% of daily trips take place using a car, and 91% of the American workforce uses one to commute.

Owning a car provides the freedom of transportation and with it, increased ownership over your schedule. Additionally, owning a car can be used to make money via a side hustle, such as driving others or delivering food, or as a source of passive income if you rent your car to others.

View this post on Instagram

America ❤️ cars

Car ownership risks

However, owning a car is not without risk. A car purchase can require significant cash upfront and additional money for ongoing expenses like insurance, fuel, and maintenance. While a car is an asset, you should not regard it as an investment. Over the first five years of ownership, you can expect a new car to depreciate between $6,000 and $10,000. The longer you use a car, the less it’s worth.

The average household spends 16 cents of every dollar on transportation, and 93% of this goes to buying, maintaining, and operating cars, the largest expenditure after housing. A household can save nearly $10,000 over time by taking public transportation and living with one less car. However, 45% of Americans have no access to public transit, and depending on your geography, alternative means of transportation may not be feasible.

If you decide the advantages of a car outweigh the risks, evaluate the features of a car best suited for your needs. Considerable features include driving style, engine size, and vehicle type. Edmunds, an American online resource for automotive inventory and information, offers a free guide to determine your vehicle needs, including questions to identify your must-have features.

Determine your Budget

Once you’re clear on the need for a car, create a budget to prepare for this expense. Edmunds advises that your monthly new-car payment should not exceed 15 percent of your monthly take-home pay. A used car will be less expensive, but the same rule should apply. If you want to lease, aim for a monthly payment of less than 10 percent of your take-home pay. Remember to set aside some of your future income for fuel, insurance, and maintenance.

Not sure what kind of vehicles fall under this monthly payment? Look at the Edmunds affordability calculator, which lists cars within your desired price range. You can adjust prices based on car features, taxes, and finance fees on the results page.

Financing for a car is usually available for those purchased from a dealership. You pay a portion of the purchase price upfront, and the remaining balance is paid for with a loan provided by your bank, credit union, or the dealership itself. On average, the interest rate charged on a car loan is 3.86% for new cars and 8.21% for used cars; however, this number varies depending on the provider and your credit score. Because interest on borrowed money increases the total price of the vehicle, strive to pay at least 20% in cash upfront.

To save time and money, get pre-approved for an auto loan from the institution you bank with. This loan can then be compared against offers from other lenders, including the dealership when you are ready to buy.

Lease vs. Buy

An alternative to buying a car is to lease it. When you lease a car, you pay monthly installments to use the car for a fixed amount of time. At the end of your lease, you return the car to the dealership. Leasing can be a preferred means of ownership because it typically requires less cash upfront, and monthly payments are often less than those for a loan. However, once the lease is over, you’ll need to begin shopping again to find a new vehicle.

While leasing a car is less expensive in the short term, owning a car can be less expensive in the long term. Once a car is paid off, you can drive it as long as possible, sell it, or trade it in to get a discount on your next purchase.

Here are a few more factors to consider when deciding between leasing and buying:

Leasing

- You can drive a more expensive car for less money.

- You can drive a new car with the latest technology every few years.

- The factory warranty will cover most repairs.

- There are no trade-in hassles at the end of the lease.

Buying

- You have more flexibility to sell the car whenever you want.

- You can modify the car to your tastes.

- There are no mileage penalties if you drive a lot.

- Your car expenses will be lower in the long run, provided you pay off the car and keep it after.

Choosing a Car

Once you know why you need a car, your budget, and whether you want to buy or lease, use tools like Kelley Blue Book, a vehicle valuation and automotive research company, to search for and compare potential vehicles. The website’s Car Finder tool identifies car models that meet your criteria, including price, mileage, brand name, and more. When you’ve narrowed your list, the site’s comparison tool can be a helpful resource for understanding the differences between similar models.

View this post on Instagram

Voice recognition is a feature

With a shortlist in hand, identify sellers of the car(s) you want to buy by searching online. While you can purchase cars from individuals, dealerships are typically more reliable and trustworthy because they hold their vehicles to higher performance standards and may offer additional services that an individual cannot, such as warranties, financing, and options for ongoing vehicle maintenance. Searching online-only dealerships can expand your pool of options. Still, they generally require a higher level of commitment, so you should be familiar with and comfortable with the car purchase process before deciding to use them. For any dealership you consider, look at the company’s customer ratings, Better Business Bureau reports, and consumer protection agency filings to establish credibility before deciding to visit. You can find additional resources for evaluating dealership quality on RealCarTips.com.

New vs. Used

Depending on your needs, a quality used car can be of higher value than a brand-new vehicle. In addition to being cheaper, well-maintained used cars usually meet all of the performance standards expected from newer vehicles. Although maintenance costs for used cars can be higher, the vehicle depreciation rate is lower, insurance costs are typically lower, and many certified pre-owned (CPO) vehicles are covered by a limited warranty.

If you decide to shop used, pay close attention to the service history, which shows all the maintenance completed since the car was first sold. If a dealership does not provide a car’s service history report, one can be generated for free using the National Insurance Crime Bureau’s VINCheck or iSeeCars. You can purchase more comprehensive service history reports for a fee from sites like CarFax. Running a report requires the car’s vehicle identification number (VIN), a 17-digit number found on the driver-side dash near the windshield. Auto dealers should provide the VIN in the vehicle’s online listing.

View this post on Instagram

Check any service history reports to ensure that repairs and maintenance align with the manufacturer’s recommended maintenance schedule. You can find maintenance schedules online by visiting the brand’s website. If the service report is satisfactory, compare the requested purchase price against the vehicle’s current market rate as determined by Edmunds or Kelley Blue Book. If the dealership’s offer price is comparable to the market rate, be prepared to pay the full offer price. If the offer price is higher than the market rate, consider finding a different seller offering a similar car at the market rate or print a copy of the service history report to negotiate with the seller.

The Purchase Process

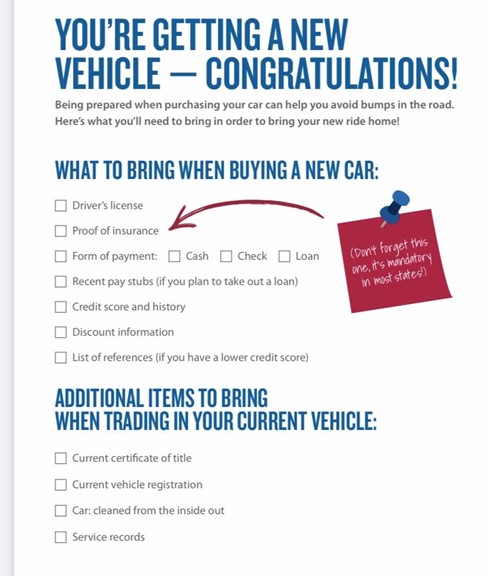

When visiting a dealership, come prepared to test drive the vehicle, negotiate pricing, and close within your budget. American Family Insurance created the following checklist for what to bring:

Test driving the vehicle allows you to practice driving it as if you owned it. With this in mind, it’s important to test drive under different situations to get familiar with the car. If possible, drive it through city streets and the highway to judge comfortability, handling, and acceleration. If any of these don’t meet expectations, consider test driving a different vehicle.

If the result of a test drive is that you’d like to buy the car, be prepared to discuss pricing.

The dealership will want to know whether you plan on financing the car and, if so, may offer to provide the loan. You can review the terms of any financing the dealership offers against the terms of your pre-approved loan.

If the price, financing, and fees look right, it's time to say yes to the deal. From here, you can proceed in one of two ways: Buy at the dealership or have the car and paperwork delivered to your home.

Most people choose to wrap up the sale at the dealership. Once you've agreed on a price, the salesperson will take you to the finance and insurance office. That's where you'll sign the contract and purchase any additional products, such as an extended warranty.

Wherever you finalize the deal, review the agreement carefully and ensure the numbers match the out-the-door breakdown. Be sure there are no additional charges or fees. If you have questions, a good finance manager will explain each form and its meaning. Take your time, and remember: There is no cooling-off period. Once you sign the contract, the car is yours.

Financing a Home