Investing Fundamentals

How to choose an investment strategy, an overview of investment products, and how to open a brokerage account.

This is a chapter preview. To read the full chapter, click here.

TL;DR

- While many different investment strategies and products exist, few outperform long-term investing in an index fund reflective of the S&P 500.

- Dollar-cost averaging, the process of investing the same dollar amount in a security over time, allows you to buy more shares when the price is low and less when the price rises. It’s also an easy way to add investing to your budget.

- Investment risks can be mitigated with diversification, a mix of various investments within a portfolio, and balanced asset allocation, the composition of your portfolio across different asset classes like cash, stocks, and bonds.

- Investors can buy and sell investments using a brokerage account. Discount brokerages offer lower fees in exchange for a do-it-yourself model, while full-service and advisory firms process trades on your behalf.

- External market conditions, including supply and demand and interest rates, impact investor sentiment and influence the price of investments.

Investing is the process of spending money with the expectation that this money will provide a profit at a later date. Investing is one of the most common approaches for reaching financial goals because it can serve as an additional source of income separate from your job.

Investing is a powerful tool to increase the value of your money over time. As covered previously, starting early has clear benefits. However, investing before you understand the risks is dangerous. If done carelessly, investing can cause you to lose more money than anticipated and jeopardize your other financial goals. For this reason, the money management strategies addressed in Spend should be understood and put in place before you prioritize investing. Without a budget, healthy spending habits, and debt under control, focusing on investing can do more harm than good.

View this post on Instagram

Investment objectives

Investment objectives generally fall within two categories: growth and income. Investors expect a growth investment to appreciate or increase in value over time. Most stocks, for example, are purchased because the buyer wishes to sell them when they reach a higher price for a profit. Similarly, you can buy assets with the intent of making a profit when you sell them at a later date. Homes, for example, can be considered a growth asset because they generally increase in value over time. When homeowners decide to sell their homes, they hope to do so at a higher price than they originally paid.

Because growth investments generally require more time to see an increase in value, they may be more appropriate for meeting long-term financial goals such as preparing for retirement.

Income investments are those expected to provide recurring payments to the investor over time. These payments are typically realized as interest or dividends paid quarterly or annually. In the debt market, borrowers pay lenders interest in exchange for borrowing money. In the equity market, some companies distribute a portion of company earnings to investors as dividends. In addition to securities, assets can sometimes be purchased as a source of income.

While income investments may appreciate over time, investors primarily seek them for a shorter return on investment. For this reason, income investments may be more appropriate for reaching near-term financial goals or as a supplement to your existing income.

Identifying your investment objectives is one aspect of determining which investments you are best suited for. This suitability is gauged by investment advisors and brokerages by assessing your various preferences, including risk tolerance, net worth, and investment experience. For example, Thrivent Capital’s suitability questionnaire asks clients to select from one of four investment objectives:

☐ Aggressive Growth - Focus is on generating growth and/or income with a willingness to assume a high level of risk.

☐ Growth - Focus is on generating long-term capital growth, offset by a low income level.

☐ Balanced/Conservative Growth - Focus is on generating current income and/or long-term growth.

☐ Preservation of Principal - Focus is on preservation of principal and/or income.

Familiarity with questions like these can help you determine your investment strategy.

Active & Passive Investing

Strategies for investing fall within one of two categories: active or passive. In an active investment strategy, the investor attempts to take advantage of short-term changes in the market to make money. Doing so requires paying close attention to the market and using available information to make time-sensitive investment decisions. While individual investors can pursue an active investing strategy, it is more commonly utilized by investing professionals who manage money for a living. Although active investing can be lucrative, it can also be time-intensive and risky. Understanding and predicting market changes takes experience and luck.

Many have tried, but few have consistently outperformed the market using an active investment strategy. Remember that in today’s digital age, market news is factored into the price of investments quickly, leaving active managers little time to make predictions before the market moves. Additionally, because many exchanges charge fees to buy and sell securities, and taxes are higher for short-term capital gains, active managers must earn higher than average returns to outperform a passive strategy. Because of these risks, active investing is best suited for those with significant investing experience and a high risk tolerance.

Conversely, passive investing is purchasing and holding an investment for an extended period, typically a year or more. Passive investors do not react to short-term changes in the market but rather construct a portfolio of investments they believe will increase in value long-term. Common passive investment strategies include buying shares of an index fund, a portfolio made to match or track the components of a financial market index, such as the Standard & Poor’s 500 Index (S&P 500). Although less day-to-day management is required, passive investments have been shown to outperform active management over time. Therefore, while active strategies should be explored and understood, it can be safer and arguably more profitable for new investors to begin with a passive approach.

Investing Risks

FINRA defines risk as any investment uncertainty that has the potential to affect your financial welfare negatively. Many risks are inherent in investing, including those described below:

- Market risk: Your investment value might rise or fall because of market conditions.

- Business risk: Corporate decisions, such as expanding into a new area of business or merging with another company, can affect the value of your investments.

- Political risk: If you own an international investment, events within that country can affect the value of your investment.

- Currency risk: The value of international investments can fluctuate depending on the exchange rate when an investment is bought or sold.

- Credit risk: The risk that the borrower of invested funds cannot repay their debt.

- Principal risk: The risk of losing the entirety of the original sum of money you spent on an investment. To prepare for this risk, as a general rule of thumb, you should not invest more than you can afford to lose.

- Liquidity risk: The risk of being unable to sell an investment when you want to.

- Concentration risk: The risk of amplified losses from having a large portion of your holdings in a particular investment, asset class, or market relative to your overall portfolio.

- Fraud risk: The possibility of losing money because an investment opportunity is not real or credible.

Determining Personal Risk Tolerance

Estimate your personal risk tolerance before investing. You can do so by self-selecting from one of the risk classifications identified in the SEC’s suitability questionnaire:

☐ Aggressive - Able to accept prolonged negative returns during difficult phases in a market cycle.

☐ Moderately Aggressive - Able to accept negative annual returns during difficult phases in a market cycle.

☐ Moderate - Able to accept only two or three quarters of negative returns during difficult phases in a market cycle.

☐ Moderately Conservative - Able to accept infrequent and very modest losses during difficult phases in a market cycle.

☐ Conservative - To minimize the chance for loss, willing to accept the lower long-term returns provided by conservative investments

All investments carry risk. Understanding risks and taking steps to manage them put you in a better position to meet your financial goals.

Addressing Risk

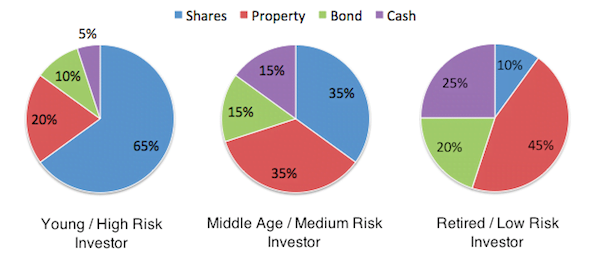

While you can’t eliminate investment risks, you can reduce them with diversification and balanced asset allocation. If done well, these strategies should balance investment performance.

Usually expressed as a percentage basis, your asset allocation is what portion of your total portfolio you'll invest in different asset classes. The most common asset classes are cash, stocks, and bonds.

Cash is the safest of these assets because it is highly liquid and less volatile than stocks and bonds. Holding cash allows you to purchase goods, services, and other investment products, and building a cash emergency savings fund can protect you in the event of financial hardship. However, cash savings can lose value over extended periods due to inflation, even if held in a high-interest savings account. Because holding cash is so low risk, it has historically underperformed other asset classes as an investment over time.

Stocks, also referred to as equities, represent an ownership stake in a company. When you invest in stock, you buy shares in a company—also known as equity shares. Your return on investment, or what you get back in relation to what you put in, depends on the success or failure of that company. If the company does well and makes more money from its products or services than it spends to sell them, its stock price will likely reflect that success.

@sahibcantsingh draft w @lilly_um_sparks ♬ original sound - Sahib Singh

Bonds, issued by a corporation, government, federal agency, or other organization to raise capital, are a common type of debt security in which the borrower agrees to pay interest in exchange for lent capital. Debt securities, also known as income securities, are financial instruments that have defined terms between a borrower (the issuer) and a lender (the investor). Most bonds have a maturity date set when the bond is issued. On a bond’s maturity date, the borrower fulfills its debt obligation by paying bondholders the final interest payment and the bond’s face value, called par value.

In this example, investing in a $100k bond pays $4,500, or 4.5% of the bond’s total value, every six months (via AccountingCoach.com)

Other asset classes commonly explored by investors include options, commodities, and real estate. All asset classes respond to macroeconomic conditions differently. By including multiple asset class types in your portfolio, you increase the likelihood that some of your investments will provide returns even if others do not or lose value.

Diversification

Diversification is a risk management strategy that creates a mix of various investments within a portfolio. Diversification reduces the risk of significant losses resulting from over-emphasizing a single security or asset class, however resilient you might expect that security or asset class to be. Diversification is especially effective if your assets are "uncorrelated," meaning they react to economic events in ways independent of other investments in your portfolio. Stocks and bonds, for instance, often move in different directions from each other, which is why holding both of these asset classes can help manage risk.

Financial experts tend to recommend diversification between asset classes and within them. For example, when investing in stocks, diversification increases when you own more than one. It increases further when those stocks are made up of different-sized companies, reflect multiple sectors, and are domestic and international. Similarly, if you're buying bonds, you might choose bonds from different issuers—the federal government, state and local governments, and corporations—as well as those with various terms and credit ratings.

Building a diversified portfolio is one of the reasons many investors turn to pooled investments such as mutual funds and exchange-traded funds. Pooled investments typically include a large number and variety of underlying investments, so they help spread out your risk. However, you still need to ensure your fund investments are diversified. For example, owning two mutual funds that reflect the same index won't help you to diversify.

These pie charts illustrate sample asset allocations based on risk tolerance

As market performance alters the value of different asset classes, you may find that your portfolio no longer reflects your personal risk tolerance or provides the balance of growth and income you want. When this happens, adjusting or rebalancing your investments can be a means of addressing changes to your investment strategy. Although no official timeline determines when you should rebalance your portfolio, advisors generally recommend doing so at least once a year.

Remember that any changes to your investments could incur sales charges and other fees. In addition to these costs, selling investments results in either a loss of income or a taxable gain.

Investment Products