Growth for Self

Health’s role in your finances and strategies to increase your personal and professional value.

This is a chapter preview. To read the full chapter, click here.

TL;DR

- You can protect yourself and save money on healthcare expenses by purchasing health insurance, building an emergency savings fund, and maintaining a healthy lifestyle

- Investing in your mental health, whether by going to therapy, nurturing close personal relationships, or practicing mindfulness, has financial benefits

- Mentorship, goal setting, and continuing education are three approaches to personal development that can advance your financial prospects at work and beyond

Prioritize your health as the foundation for a sustainable relationship with money. Your body is your greatest asset; the healthier it is, the easier it is to earn, maintain, and enjoy your income. Just as building financial skills and practicing good habits is necessary to reach your financial goals, investing in your health is essential for long-term prosperity.

Physical health

The American healthcare system is a $4.1 trillion industry. Although the government spends a significant portion of the nation’s GDP on healthcare, private spending and out-of-pocket expenses paid by U.S. consumers are higher than in other high-income countries.

Source: Roosa Tikkanen and Melinda K. Abrams, U.S. Health Care from a Global Perspective, 2019: Higher Spending, Worse Outcomes? (Commonwealth Fund, Jan. 2020). https://doi.org/10.26099/7avy-fc29

On average, Americans spend $12,530 on their health every year, but this number varies depending on one’s reliance on and relationship with the healthcare industry. Unfortunately, about half of U.S. adults say it is difficult to afford their healthcare costs, and 41% report having debt due to medical or dental expenses.

Therefore, it pays to be prepared. You can lower your chances of being overwhelmed by healthcare costs by purchasing health insurance, building an emergency savings fund, and maintaining a healthy lifestyle.

Health insurance

Health insurance helps you save money by transferring the majority of financial risk associated with medical expenses to an insurer in exchange for a premium or monthly rate. It’s easy to underestimate how much medical care can cost:

- One ambulance ride can cost over $1,000

- Fixing a broken leg can cost up to $7,500

- The average cost of a three-day hospital stay is around $30,000

Having health coverage can help protect you from high, unexpected expenses like these.

View this post on Instagram

Insurance plans cover essential health benefits, preventative health services, and treatment for pre-existing conditions. Dental and vision coverage may or may not be included in a health insurance plan. Depending on your needs and state regulations, insurance plans don’t always cover cosmetic procedures, fertility treatments, off-label prescriptions, and, in some cases, recently introduced medical products and services. Further details regarding what is and is not covered by health insurance are available on Healthcare.gov.

With a health insurance plan in place, financial protection begins once you pay your plan’s deductible, the amount paid for health care services in a given year before your insurer starts to cover expenses. For example, if you have an insurance plan with a $2,000 deductible, you would pay the first $2,000 of covered services yourself. Between 60-90% of expenses beyond your deductible are paid for by your insurer, and the remaining 10-40% of the costs you pay as coinsurance or copayments.

Insurance plans offer an out-of-pocket maximum, the total limit on the amount you'll have to pay no matter how much covered care you get in a plan year. For example, if your plan has a $2,500 out-of-pocket maximum, once you spend $2,500 in deductibles, coinsurance, and copayments, the plan pays for any additional covered care for the rest of the year. Additionally, health insurance plans cannot place a limit on the dollar value they will cover for qualified medical expenses, i.e., essential health benefits.

To get a health insurance plan, if you are under 26 and your parents are insured, you can be covered by their policy until your 26th birthday, after which you’ll need to enroll in your own policy.

Many employers offer health insurance as part of their compensation package. In fact, health insurance is the largest nonwage component (26 percent) of employee compensation. In an employer-sponsored health insurance plan, the company pays for most of the premium, and you pay for the difference as well as any deductible, copayment, or coinsurance costs. This is a more affordable means of getting healthcare as employer-sponsored plans average $622.50 a month; however, individual employees are typically only responsible for $105 of that amount.

Suppose you cannot get health insurance through your parents or employer. In that case, you can enroll in a policy through the Health Insurance Marketplace (the Marketplace), a service available in every state that helps individuals, families, and small businesses shop for and enroll in medical insurance. Open enrollment for a given year opens November first of the year prior; however, you may be able to access insurance sooner if you qualify for special enrollment, Medicaid, or the Children’s Health Insurance Program (CHIP).

The Marketplace is a network of insurers approved by the government to provide financial protection for essential health services. Individual plans on the healthcare exchange range from an average of $273 to $648 monthly. To estimate the prices of qualifying health plans before enrolling, use the HealthCare.gov search tool. When you're ready to apply, follow the directions outlined on HealthCare.gov.

Plans in the Marketplace are presented in four health payment categories: Bronze, Silver, Gold, and Platinum. Plan categories are based on how you and your insurer split healthcare costs and have nothing to do with the quality of care. In a bronze plan, monthly premiums are lower, but the deductible is higher. These plans may be preferable to healthier individuals who do not plan on using their health insurance often. Conversely, platinum plans charge a higher premium, but the deductible is much lower. These plans may be preferable to those who expect to frequently use their coverage and wish to pay a smaller deductible before their insurance starts covering costs.

Health insurance plans also differ in the network of doctors, hospitals, pharmacies, and other medical service providers they pay for. Certain providers and services may be covered by one insurance plan but not another. You can search for local providers and the insurance they accept using ZocDoc.com, a free app that helps patients book appointments with doctors in their network.

Health insurance is a complicated but necessary aspect of managing your finances. Should you need further assistance, refer to your employer, resources available through HealthCare.gov, and consider consulting with a financial advisor.

Build an emergency savings fund

Having health insurance greatly reduces the risk of financial hardship due to medical expenses. Nevertheless, despite being insured, many people still face large and variable out-of-pocket healthcare costs. In 2017, more than 1 in 50 Americans who interact with the healthcare system had out-of-pocket costs in excess of $5,000, and 1 in 200 had costs over $10,000.

Therefore, having excess cash available at your disposal can protect you from unexpected medical bills. Aim to save the out-of-pocket maximum for your insurance policy when determining how much of an emergency savings fund you should save for potential medical expenses. If your health plan complies with the Affordable Care Act (ACA), your out-of-pocket maximum will be at most $8,550 for individuals and $17,100 for families as of 2021.

Additionally, consider saving money for healthcare expenses in a Health Savings Account (HSA), a type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. While you can use the funds in an HSA at any time to pay for qualified medical expenses, you may contribute to an HSA only if you have a High Deductible Health Plan (HDHP) — generally a health plan that only covers preventive services before the deductible. Marketplace plans must disclose whether they are HSA-eligible. In 2022, if you had an HDHP, you could contribute up to $3,650 for self-only coverage and up to $7,300 for family coverage into an HSA. HSA funds roll over annually if you don't spend them, and may earn interest or other earnings, which are not taxable.

If possible, avoid going into debt to pay for unexpected medical bills. Doing so can negatively impact your credit and delay other financial goals. If you do not have enough money to cover unexpected medical expenses, consider the following approaches before borrowing money:

- Check the bill for errors. If you find any discrepancies in your itemized invoice, inform your doctor's billing manager, the hospital, or the insurance provider immediately. You can question the charges to pursue a new and accurate bill. Ask for the details, not just a summary of the amount due.

- Negotiate a lower payment. You can contact the billing department of your healthcare provider to negotiate a reduced amount. Most hospitals have charity care or financial assistance programs for individuals who cannot afford to pay for medical treatment. Participating hospitals may request your income records to verify eligibility.

- Negotiate the payment terms. If you can't negotiate a lower payment, try discussing the payment terms, like paying a smaller amount for an extended period, having a discounted amount if you pay sooner, or agreeing on a zero-interest payment plan.

- Check if you qualify for Medicaid. Medicaid is a joint federal and state program that can help pay medical costs for low-income individuals and is administered differently in each state. You can visit the national Medicaid website or your state's Medicaid site to get more information and see if you qualify.

- Review expenses with a medical bill advocate. Advocates can analyze your bill to spot errors, negotiate lower payments to settle your bill or follow up with your insurance company to ensure you maximize your coverage. They understand the system and will work on your behalf to reduce your medical bills. Advocates are typically paid hourly or for a percentage of the money they save you.

Preventative healthcare

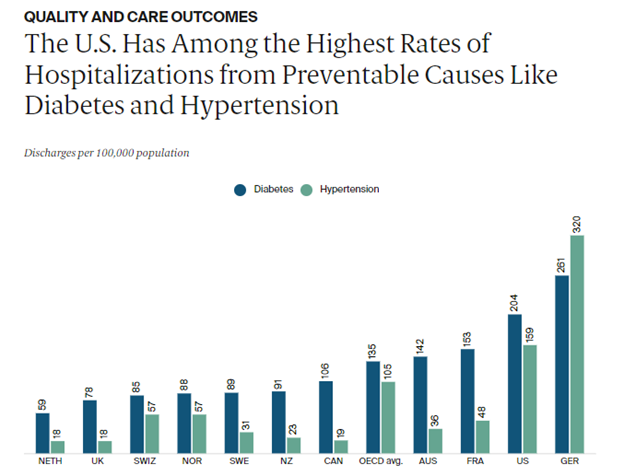

Being healthy is one of the best methods for avoiding costly medical expenses. Poor physical health increases the likelihood of contracting chronic conditions such as hypertension, heart disease, or diabetes. More than one-quarter of U.S. adults report being diagnosed with two or more chronic conditions during their lifetime, compared to 22 percent or less in all other countries. Chronic conditions lower your quality of life, negatively impact your ability to earn money, and can require expensive ongoing treatment to manage. For example, individuals with hypertension are estimated to face nearly $2,000 higher annual healthcare expenditures than their nonhypertensive peers, and people with diagnosed diabetes have medical expenditures approximately 2.3 times higher than those without.

Many chronic diseases are caused by key risk behaviors such as physical inactivity, poor nutrition, tobacco use, and excessive alcohol consumption. Avoiding these risk behaviors can be difficult when money is a concern. Nevertheless, you can mitigate them on a budget through proper nutrition, exercise, and sleep.

Nutrition

A balanced diet is the cornerstone of a healthy lifestyle. According to the Dietary Guidelines for Americans 2020–2025, a healthy eating plan:

- Emphasizes fruits, vegetables, whole grains, and fat-free or low-fat milk and milk products,

- Includes a variety of protein foods such as seafood, lean meats and poultry, eggs, beans, nuts, and seeds,

- Is low in added sugars, sodium, saturated fats, trans fats, and cholesterol, and

- Stays within your daily caloric needs.

The US Department of Agriculture created the MyPlate website to provide resources to support building healthy and budget-friendly meals. Users can learn about nutrition and access cheap, affordable recipes that meet recommended nutritional guidelines.

MyPlate also launched the Start Simple with MyPlate app to gamify nutrition by providing tools, tips, and recommendations for healthy eating on a budget. The app identifies savings at local grocery stores and includes suggestions for buying and preparing budget-friendly foods. Learn more by visiting the MyPlate and CDC websites.

Physical Activity

Being physically active can improve your brain health, help manage weight, reduce the risk of disease, strengthen bones and muscles, and improve your ability to do everyday activities. Physical exercise reduces the risk of chronic disease and increases your life expectancy. Other benefits include improved sleep, increased energy, and better cardiovascular fitness.

While vigorously working out can further the benefits experienced by physical exercise, doing so isn’t necessary to obtain the primary benefits of managing your weight, reducing the risk of chronic disease, and improving your mental health. Even low to moderate exercise throughout the week can reduce depression and anxiety, so much so that some doctors recommend trying out an exercise regimen for these conditions before turning to medication. Therefore, prioritize consistency over vigor and do what feels best for you.

View this post on Instagram

The CDC offers free tools to manage your physical health, such as an activity planner and diary to schedule and monitor your progress. Additionally, an abundance of free resources exists online. Here’s 50.

I love this guy

Additional tips for building the habit of regular exercise are available on the HelpGuide website, a nonprofit organization that runs one of the world’s leading mental health websites.

Sleep

Sleep is another deterrent for chronic diseases. Quality sleep increases life expectancy and is required to reap the full benefits of physical health and nutrition.

The amount of sleep you need varies by age, with children ages 6-13 needing 9-11 hours of sleep, teenagers 8-10 hours, and adults 7-9. However, the quality of sleep you attain is just as important as the number of hours you sleep. Habits to practice for healthy sleep include the following:

- Be consistent. Go to bed at the same time each night and get up at the same time each morning, including on the weekends

- Make sure your bedroom is quiet, dark, relaxing, and at a comfortable temperature

- Remove electronic devices, such as TVs, computers, and smartphones, from the bedroom

- Avoid large meals, caffeine, and alcohol before bedtime

- Get some exercise. Being physically active during the day can help you fall asleep more easily at night.

View this post on Instagram

More information is available on the CDC website and SleepEducation.org.

Mental health

Mental health is priceless; it determines your clarity of thought, relationships with others, and overall satisfaction with life. A healthy mind makes it easier to navigate job-related stresses and manage work relationships. Practicing good mental health habits improves your ability to maintain healthy financial habits, such as committing to a budget. Furthermore, a well-regulated mind is less likely to overspend on high-risk investments.

Proper physical health is a significant contributor to a healthy mind, but there are additional steps you can take to improve the mind-body relationship. You have the same brain for your entire life — it’s in your best interest to take care of it.

Healthcare resources

If you are experiencing or believe you may be experiencing mental illness, Marketplace health insurance plans are required to cover behavioral health treatment, such as psychotherapy and counseling, mental and behavioral health inpatient services, and substance use disorder or substance abuse treatment. Your specific health benefits will depend on the state you live in and the plan you choose. You’ll see a complete list of what each plan covers, including behavioral health benefits, when comparing them in the Marketplace.

Pre-existing mental and behavioral health conditions are covered, and spending limits aren’t allowed. This means that if you are diagnosed with mental illness before applying for health insurance, you can’t be denied coverage, and there isn’t a limit to the dollar value insurers must pay to cover treatment. Additionally, Marketplace plans must provide parity between mental and physical health services, meaning each fee structure and treatment plan will be comparable. Company plans that are not listed on the Marketplace may not provide the same coverage for these services, so if you get health insurance through your employer, consult with your company’s human resources team to learn the specifics of your benefits.

View this post on Instagram

Verywell Mind, a resource for up-to-date information on mental health topics, offers recommendations for the best mental health insurance plans.

Having health insurance can make it easier to afford therapy, a form of treatment aimed at relieving emotional distress and mental health problems. Even if you feel mentally healthy, therapy can help you navigate life’s difficulties, challenge unhealthy beliefs, and process traumatic experiences. Therapists are sworn to privacy and professionally licensed to provide constructive advice, unlike friends and family, who may not be as qualified or impartial.

While you can have therapy sessions in person, many therapists allow patients to contact them over the phone or even text — whatever you’re most comfortable with. If you’re looking for specialized therapy beyond what your insurance plan covers, consider an online therapy platform.

Relationship Management

In addition to therapy, find people with whom you can share personal experiences and get support. In any relationship, it pays to have high standards. Loved ones in your life should be willing and able to be there for you in times of need, and you should likewise aim to reciprocate.

View this post on Instagram

Close relationships are shown to reduce the risk of many significant health problems and contribute to longevity. Additionally, those closest to us influence our attitudes, aspirations, and behavior. The more driven and successful the people you surround yourself with, the more likely you are to be driven and successful. Conversely, the more superficial your relationships are, the more likely you’ll reflect that characteristic. Prioritize time with people that make you want to be a better person — you are the company you keep.

Finding good friends isn’t always easy. Nevertheless, you can increase your chances of success by routinely doing activities you enjoy around others, whether playing sports, going to a place of worship, or doing a hobby in public. Meetup.com is a social media site that allows anyone to create or join a group of people meeting based on shared interests. Additionally, sites like Bumble BFF let you swipe through people in your area interested in becoming friends.

Mindfulness

Just as building relationships with others is necessary for good mental health, developing a healthy relationship with yourself is equally important. Mindfulness, the psychological state of awareness, can help you do so.

The American Psychological Association defines mindfulness as the moment-to-moment awareness of one's experience without judgment. In this sense, mindfulness is a state and not a trait. While it might be promoted by certain practices or activities, such as meditation, it is not equivalent or synonymous with them.

Practicing mindfulness is shown to reduce stress, improve focus, and decrease emotional reactivity. Anecdotally, mindfulness strengthens your ability to be aware of your behavior with less judgment, which enhances your ability to manage relationships and cultivate an attitude of thankfulness.

Financially, mindfulness can improve financial goal-setting and decision-making. Self-reflection can be a healthy approach to keeping your financial goals in mind. Part of living in the moment is paying attention to where you are and what you are doing, including how you are spending your money. Do you ever stop to ask yourself, is this expense or purchase really necessary? CNBC reports that the average consumer spends $450 per month or $5,400 per year on impulse purchases. If you are money-mindful, you could turn those dollars wasted on impulse buying into savings for your goals.

While mindfulness is a tool you can always use, it is most commonly learned and rehearsed through dedicated periods of practice called meditation. A variety of free resources offer guided meditation during which a speaker suggests what to focus on for a given length of time. For example, the Waking Up app provides daily guided meditations to practice mindfulness. The app is free for five introductory meditations and theory lectures, then costs $14.99/month. However, anyone who can't afford it can get a free year of premium access.

Take a deep breath, relax, and remind yourself this will help save you money.

Personal development